Содержание

- 2. Largest nutrition and foods company in the world Founded and headquarterd in Vevey, Switzerland Nestle originated

- 3. Key Figures Revenue 107.6 billion Operating Income 15.7 billion Profit 10.43 billion Total Assets 110.9 billion

- 4. Nestle has 8500 brands with a wide range of products across a number of markets including:

- 5. Growth Strategies Forced by Switzerlands small size Established its first foreign offices in U.S.A and Great

- 6. Emerging Markets Does it make sense for Nestle to focus on emerging markets? Infrastructure / Political

- 7. Profits of Adversity Nestlé's sales in emerging markets up 8.5% last year Double the rate of

- 8. Growth of Emerging Markets Propensity 1 billion consumers in emerging markets will increase their incomes enough

- 9. Population Growth Distribution

- 12. Investing In Emerging Markets “Nestle will receive $28.1 billion from Novartis for its majority stake in

- 13. Investing in Emerging Markets “Nestle may purchase bottled water businesses in markets such as China” Frits

- 14. Strategy to work effectively Flexibility is another distinctive competencies which Nestle company was able to achieve

- 15. The Nestle company uses that approach in order to the convenient fact that the consumer is

- 16. Nestlé's strategy in emerging markets The Key strategy: Customization rather than globalization.

- 17. Executing the strategy Flexibility Local adaptation A long-term focus

- 18. In Nigeria: the company hired local singers to go to towns and villages offering a mix

- 19. Nestle Organizational Structure Moving from Localization strategy to Transnational strategy Includes first mover advantage, local economies,

- 20. Nestle Organizational Structure Seven global strategic business units classified by food type (worldwide production divisional structure)

- 23. Скачать презентацию

Маркетинговое исследование. Товар: печенье BanZai

Маркетинговое исследование. Товар: печенье BanZai Spectator - беспилотный авиационный комплекс

Spectator - беспилотный авиационный комплекс Box Big Combo-DFM-A1

Box Big Combo-DFM-A1 Product range of the company Eko3 LLC

Product range of the company Eko3 LLC Project: Global Social Media Plan // June Topic: Eyes in the Back Format: image Date: Flexible Content

Project: Global Social Media Plan // June Topic: Eyes in the Back Format: image Date: Flexible Content Experiential маркетинг– построения имиджа бренда через вовлекающие эмпирические активации

Experiential маркетинг– построения имиджа бренда через вовлекающие эмпирические активации Тренинг 3 минуты в лифте

Тренинг 3 минуты в лифте Ziaja Продукт высокого качества

Ziaja Продукт высокого качества Метод 635

Метод 635 Тренинг. Государственные закупки

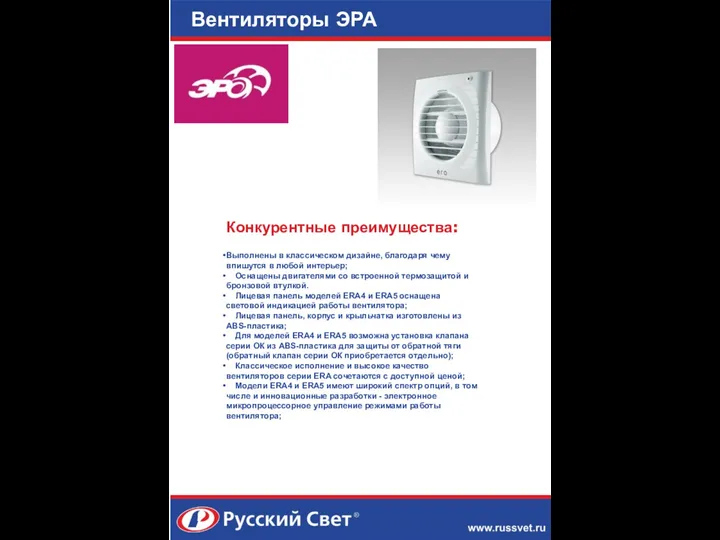

Тренинг. Государственные закупки Вентиляторы Эра

Вентиляторы Эра Интернет-маркетинг для Вашего бизнеса

Интернет-маркетинг для Вашего бизнеса Скидки. Бытовая химия

Скидки. Бытовая химия Уборка высокого качества

Уборка высокого качества Маркетинг как философия и методология современного предпринимательства

Маркетинг как философия и методология современного предпринимательства Gts – fit вместе от минимума к максимуму

Gts – fit вместе от минимума к максимуму Управление интегрированными коммуникациями. Контент-маркетинг

Управление интегрированными коммуникациями. Контент-маркетинг Совершенствование инструментов государственного управления в сфере туризма

Совершенствование инструментов государственного управления в сфере туризма Avon club. Клуб умных покупок

Avon club. Клуб умных покупок Универсальная колеровочная паста. Стандарт

Универсальная колеровочная паста. Стандарт Проверка технических условий. Ты в МТС!

Проверка технических условий. Ты в МТС! Сетка Кволит. Качественная сетка по отличной цене

Сетка Кволит. Качественная сетка по отличной цене Маркетинг Холдинга 1-9-90. Закон успеха

Маркетинг Холдинга 1-9-90. Закон успеха Оформлення весілля

Оформлення весілля Элементы организационной культуры фабрики тортов Mirel

Элементы организационной культуры фабрики тортов Mirel Рекомендации IAB Russia по качественной рекламе

Рекомендации IAB Russia по качественной рекламе Evart corporation

Evart corporation SMART - цели

SMART - цели